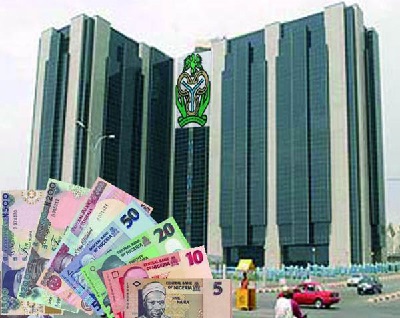

The nation's apex financial institution, the Central Bank of Nigeria (CBN), has liquidated a yet another bank and revoked its license. Barely few weeks after the collapse of Skye Bank, same fate has befallen a community bank in Bauchi, Garu Micro-Finance Bank, the News Agency of Nigeria (NAN) reports.

The manager of the bank, Ibrahim Abubakar, told NAN in Bauchi on Tuesday that the Central Bank of Nigeria (CBN) had revoked its license, adding that the bank had been taken over by Nigeria Deposit Insurance Corporation (NDIC).

The manager said the micro-finance bank was closed because it was facing liquity problem.

“The bank was closed because the shareholders of the bank have been unable to recapitalise it,” he said

According to him, timing of the closure is inauspicious because they are currently paying pensioners and September salaries.

“All the same the NDIC and the management are collecting forms from depositors to process their payment with designated banks across the state, to enable them receive their money,” he assured.

He said the microfinance bank had been operating for over 20 years in the state, adding that pensioners and other depositors had gotten used to the bank.

A senior staff of the Nigerian Deposit Insurance Corporation (NDIC), Bauchi office, who spoke to NAN on condition of anonymity, said the CBN approved the liquidation of the bank.

“The CBN has revoked the licence of Garu Micro Finance Bank Bauchi,for its inability to meet up with the financial obligations guiding operations of micro finance banks,” he said.

According to him, as soon as the NDIC officially deems that a bank has failed and is unable to meet its credit obligations, it notifies customers and the public, that it has assumed the responsibilities of receiver.

“It closes the doors to the public and immediately starts working with the bank’s staff to bring the books of account up to date, and ultimately post all relevant entries to the bank’s general ledger.

“This liquidation process entails more than converting assets to cash. It also involves finding new ownership for the failed bank,” he said.

He however assured that the NDIC would determine the number of depositors, their individual deposits and work out modalities for refunding their money.

Meanwhile, customers of the bank, most of them pensioners, expressed concern at the development, urging the state government and shareholders to come to their aid.

A customer and a pensioner, Bala Halliru, told NAN that he came to withdraw some amount and met the bank closed.

“This embarrassment is too much; this bank has been in existence for over 25 years,” he complained .

Another customer, Lydia Orgu, expressed same sentiment, saying that she felt pained by the development.

(NAN)

No comments:

Post a Comment